- Starling introduced an on line portal for personal and joint account holders, becoming a member of the smaller rank of its peers offering online banking.

- And on-line banking could extend consumer lifetime value for Starling, by enabling operation that mobile is poorly equipped to take care of.

- Insider Intelligence publishes hundreds of analysis reports, charts, and forecasts on the Banking sector with the Banking Briefing. You can discover additional about subscribing right here.

The United kingdom-centered neobank released on line banking for particular and joint account holders, its very first foray into a non-mobile channel for particular account holders, for each AltFi.

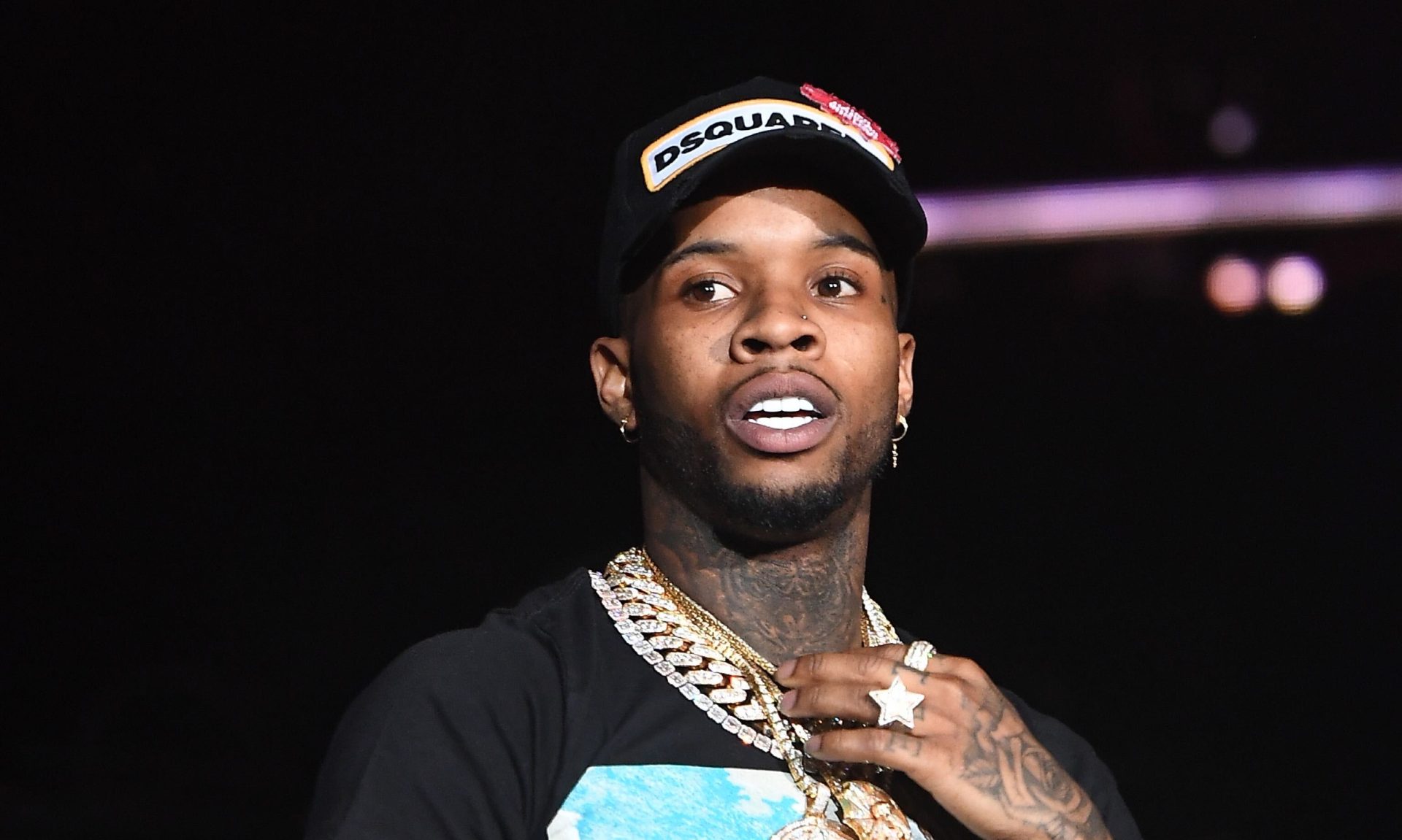

Enterprise Insider Intelligence

The launch follows the release of Starling’s on the net banking portal for SMB clients previous tumble. The pitch at the time was that on the net obtain would assist firms manage more complex finances, like setting up recurring payments and exporting statements. It was also a prerequisite of the £100 million ($127.6 million) that Starling obtained from the UK’s Banking Levels of competition Cures fund past calendar year.

On line banking is a hole that neobanks should fill to deepen interactions and develop their buyer bases.

- Best neobanks emphasize cellular banking, but capabilities and performance fall short of customer anticipations. Apps are a source of destructive sentiment for 15% of United kingdom electronic lender prospects polled by BrandsEye and Finder, creating it the survey’s second-most cited source of frustration—a bad indication for neobanks, given that applications are the key platform by means of which to interact with prospects. In point, leading British isles neobanks have largely neglected alternatives to mobile: Revolut isn’t going to give online banking at all, when Monzo and Monese offer only stripped-down versions of their applications on-line.

- Starling promises features that are out there on cellular, blown up to size for the desktop, but early operation isn’t really on par with the application. Debut on-line banking features contain Starling’s marquee, even though really commoditized, investing insights and card controls. But it excludes app-only characteristics like account opening, worldwide payments, and overdraft and personal loan programs.

Online banking could increase client life span worth for neobanks by enabling sophisticated functionality that mobile is badly outfitted to take care of. As neobanks glimpse to grow their products lineups past basic examining and personal savings accounts and into offering goods like home loans, their purchaser interfaces will need to preserve up.

Cell-initially banking institutions targeting millennials and Gen Z hit a hurdle when that demographic’s finances get a lot more complex than a tiny quantity of essential economic items: People buyers will have vastly a lot more items and financial milestones to preserve observe of that would be better presented in a comprehensive dashboard. That structure does not in good shape on a smartphone monitor. Neobank growth is in component incumbent on customers’ evolving wants for far more complicated money items. And in advance of neobanks can offer you individuals items, consumers need to have a way to administer them.

Want to go through a lot more tales like this a single? Here’s how you can attain accessibility:

- Join other Insider Intelligence purchasers who obtain this Briefing, together with other Banking forecasts, briefings, charts, and analysis experiences to their inboxes just about every day. >> Become a Consumer

- Investigate linked matters additional in depth. >> Look through Our Protection

Are you a recent Insider Intelligence shopper? Log in right here.